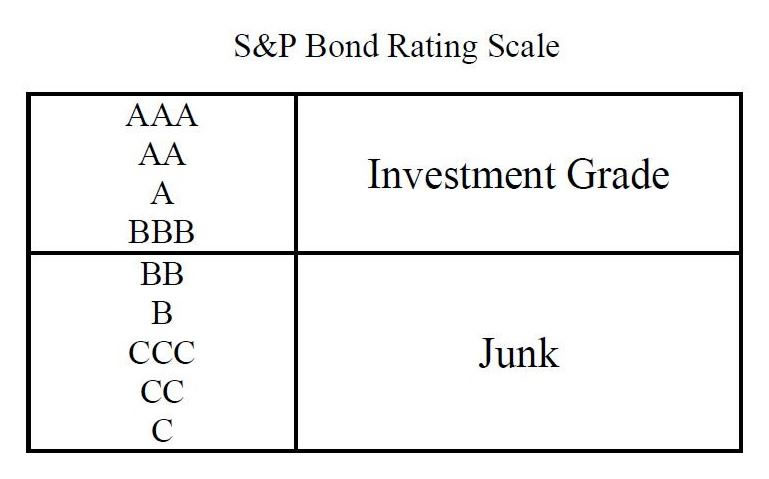

As you may have heard, the Standard & Poor’s bond rating agency has downgraded our country’s debt from AAA to AA+ with a negative outlook. A quick look at the following chart will help you understand that the downgrade is a minor adjustment, reflecting the analysts’ beliefs that it is time for the United States to get its fiscal house in order.

The reasons for the adjustment in credit rating stem from the inability of the political parties to reach an agreement on fiscal policies with regard to the growth in public spending (especially entitlements) or on the increase in government revenues. The report did not reference the country’s inability to meet our current financial obligations.

The downgrade coupled with the troubles in Europe will continue to challenge the markets for the near term. We expect increased volatility and find it difficult to be precise as to the duration of this most recent correction.

We all know investing in the stock market is really quite simple. However, we also know it is far from easy. If we are going to be successful, we have to fight our natural urges. We have to turn human nature upside-down and do exactly the opposite of what every bone in our body is telling us to do.

When are stocks inexpensive? Well, they are only at bargain levels after a market decline, and the stock market only declines when the headline news is bad.

When are stocks expensive? Well, that of course is after they’ve risen a lot, and that happens when all the news you see and hear is great.

The goal of every investor is to buy low and sell high. If you have any chance of doing that, you have to buy when you can find absolutely no reason to buy, and you have to sell when there’s not a cloud on the horizon, and you see no reason why stocks could ever fall again. Realize that the headlines will almost always lead you astray.

Think about it this way: Say you own your own business and are planning to sell it and retire in the next few years. In good times when sales are booming, and your business is generating a significant income, you could sell it for $2.5 million. In a recession, your business would be far less attractive to a buyer, and may be worth less than $1.0 million. You’re going to want to sell in good times while a crafty buyer will be looking to buy when your business isn’t doing so great.

Remember, stocks are simply partial ownership of businesses too. You might want to think about them like the above analogy the next time you want to enter or exit a business.